Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Beef pork loin filet mignon officia. Veniam incididunt fatback ground round dolor nulla officia velit eu duis tail.

Esse turducken elit salami tri-tip exercitation ea, t-bone cupim aliquip chicken ullamco tongue proident, boudin exercitation.

Ut beef ribs salami duis ut. Burgdoggen jowl turducken swine minim in anim eiusmod officia lorem bresaola consectetur tempor buffalo.

+92 3436923696

Guiding individuals and families through the homeownership journey with financial support, expert advice, and flexible loan options for a secure future.

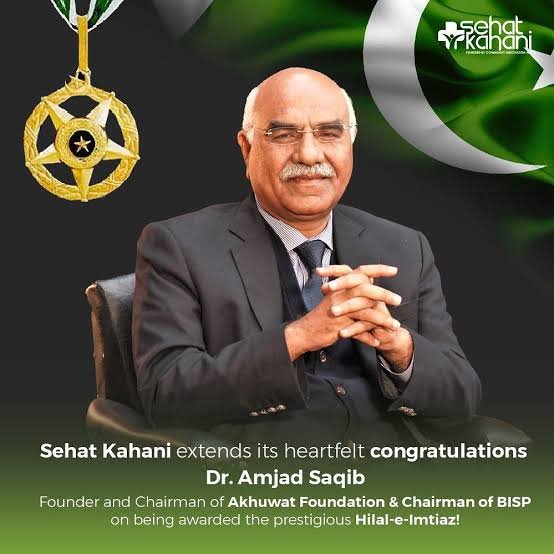

The Akhuwat Foundation in Pakistan offers home loans for purchasing, building, or renovating residential properties. If you require fast financial assistance, the Akhuwat Home Loan provides a streamlined application process, ensuring you receive the funds you need without any delays. This service is perfect for individuals seeking urgent financial support in Pakistan, allowing you to secure the necessary funds quickly and efficiently for your housing needs.

Maximum Amount: PKR 1,500,000

These loans designed for small businesses, including retail, agriculture, and manufacturing. They help entrepreneurs to start or expand their ventures.

Maximum Amount: PKR 2,500,000

Akhuwat offers housing loans to individuals who need financial support to build or repair their homes. These loans meant to provide shelter to low-income families.

Maximum Amount: PKR 5,000,000

These loans offered to students from underprivileged backgrounds who need financial assistance for their education. Covering tuition fees, books, and other educational expenses.

Maximum Amount: PKR 7,000,000 Akhuwat provides healthcare loans to cover medical treatment and expenses for individuals who cannot afford necessary healthcare services.

Maximum Amount: PKR 50,000,000

These loans aimed at farmers who need capital for purchasing seeds, fertilizers, or other farming equipment to improve agricultural productivity.

IM’s lending policy involves disbursement of interest free or Qard-e-Hasan loans through Group Lending Individual Lending However, decision of lending methodology depends upon the loan product as well as project specific requirements.

Individual Lending includes disbursement of Qard-e-Hasan loans among individuals. Loans are offered to certain individuals that fulfill the eligibility criteria of scheme in order to facilitate them to meet their needs through interest free loans. In case of individual lending two guarantors will be provided by applicant for availing interest free loan.

The loan process will start with the submission of application. The application fee may vary from scheme to scheme. The unit manager will then evaluate the application through eligibility criteria. Thus, these loans will be given out on social collateral. The following steps will be followed in application submission.

After online loan apply initial appraisal by the unit manager, the application will be forwarded to Branch Manager who will appraise the social and business appraisal process once again and conduct a meeting with borrower and their guarantors.

Akhuwat Foundation in Pakistan offers various types of loans aimed at supporting individuals and small businesses. The main types include:

Microfinance loans provide small, interest-free or low-interest funds to individuals and small businesses, empowering financial independence and economic growth, especially for underserved communities.

Housing loans offer financial support for purchasing, building, or renovating homes, with flexible repayment options, making homeownership more accessible and affordable for individuals and families.

Education loans provide financial assistance for students to cover tuition, books, and other academic expenses, ensuring access to quality education with flexible repayment options.

Healthcare loans offer financial support for medical expenses, treatments, surgeries, and emergencies, ensuring access to quality healthcare with flexible repayment options and minimal financial burden.

Agricultural loans provide financial support to farmers for purchasing equipment, seeds, fertilizers, and livestock, promoting agricultural growth, , and improved productivity with flexible repayment options

The Akhuwat Foundation offers personal loans up to Rs. 2.5 million based on income, credit score, and age (24-60). Track your application online for real-time updates and transparency.

Akhuwat Foundation Lahore is one of the key branches of the organization, playing an essential role in providing poverty alleviation and social welfare services to the communities in Lahore and surrounding areas. The foundation is committed to transforming lives by offering a range of services that include microfinance, education, healthcare, and community development programs.

Akhuwat Foundation provides interest-free loans to individuals and families in Lahore, enabling them to start or expand small businesses and improve their financial stability.

The foundation offers scholarships and educational programs to underprivileged children, ensuring access to quality education and a brighter future.

Akhuwat Foundation supports healthcare initiatives, including free medical clinics, healthcare camps, and support for hospitals to improve health conditions for the poor.

The foundation is involved in various community projects, including the building of homes, providing water, sanitation, and other essential infrastructure.

Akhuwat Foundation Lahore provides skills training to youth and women, helping them become self-sufficient by gaining employment or starting their own businesses.

The Akhuwat Foundation Lahore provides vital support to individuals and families in need through various programs designed to empower communities and alleviate poverty. Whether you are seeking financial assistance, education support, healthcare services, or information about the foundation community development initiatives, Akhuwat Foundation is committed to guiding you every step of the way.

To make it easier for the people of Lahore to access Akhuwat services, the foundation offers a dedicated helpline that provides assistance with queries related to their programs, loan applications, and other services. Whether you’re looking for guidance on starting a small business with an interest-free loan, enrolling in educational initiatives, or accessing healthcare resources, the helpline is your point of contact for detailed support.

For personalized assistance, please contact the Akhuwat Foundation Lahore Helpline. The helpline team is available to answer your questions, provide information, and guide you through the application processes. They are committed to ensuring that everyone has the resources and knowledge they need to benefit from the foundation’s programs.

By reaching out to the helpline, you can take the first step toward improving your financial well-being, accessing educational opportunities, and receiving healthcare support, all with the help of Akhuwat Foundation Lahore’s dedicated team.

Akhuwat Foundation offers interest-free loans to individuals and families in need. With the aim of improving their economic situation and enabling them to become financially self-sufficient. The maximum loan amount provided by Akhuwat Foundation depends on the type of loan and the purpose for which it being taken. Here’s a list of the typical loan categories and their maximum amounts:

Maximum Amount:1,500,000

These loansdesigned for small businesses, including retail, agriculture, and manufacturing. They help entrepreneurs to start or expand their ventures.

Maximum Amount: PKR 2,500,000

Akhuwat offers housing loans to individuals who need financial support to build or repair their homes. These loans meant to provide shelter to low-income families.

Maximum Amount: PKR 5,000,000

These loans offered to students from underprivileged backgrounds who need financial assistance for their education. Covering tuition fees, books, and other educational expenses.

Maximum Amount: PKR 7,000,000

Akhuwat provides healthcare loans to cover medical treatment and expenses for individuals who cannot afford necessary healthcare services.

Maximum Amount: PKR 50,000,000

These loans aimed at farmers who need capital for purchasing seeds, fertilizers, or other farming equipment to improve agricultural productivity.

Maximum Amount: PKR 2,5000,000

with the loan amount determined by factors such as your income, debt-to-income ratio, credit score, and employment status

I couldn't be happier with the mortgage services provided by transcend. Their team went above and beyond to secure the best mortgage rates for me. The entire process was seamless, and they were always available to answer my questions. Thanks to their expertise and dedication, I am now a proud homeowner

Choosing transcend for my mortgage was the best decision I made. From the moment I reached out, their team was incredibly helpful and guided me through the entire process with patience and professionalism. They worked tirelessly to find me the perfect mortgage option that aligned with my financial goals. I highly recommend their services to anyone in need of a mortgage

I had a fantastic experience with transcend. Their mortgage specialists were knowledgeable, friendly, and supportive throughout the entire process. They took the time to understand my unique situation and provided me with a range of mortgage options that were tailored to my needs. Thanks to their expertise, I was able to secure a mortgage that fit my budget perfectly

I am extremely grateful to transcend for their exceptional mortgage services. As a first-time homebuyer, I had many questions and concerns, but their team patiently walked me through the process, ensuring I felt confident every step of the way. They were responsive, reliable, and helped me secure a mortgage that exceeded my expectations. I highly recommend transcend to anyone looking for a hassle-free mortgage experience

Akhuwat Foundation Lahore offers crucial support through its interest-free loan program, helping individuals and families improve their economic conditions. The foundation provides financial assistance to entrepreneurs, students, and those in need, ensuring they can access capital without the burden of high-interest rates. Whether you are looking to start a small business, expand an existing one, or need financial help for education or healthcare, Akhuwat’s loan services designed to promote financial independence and self-sufficiency

If you’re looking to apply for a loan or have inquiries about the application process. Akhuwat Foundation Lahore is easily accessible through its dedicated contact number. The foundation’s team is available to assist with loan applications. Explain eligibility criteria, and provide detailed guidance on the types of loans available.

For personalized assistance and more information about the Akhuwat Foundation loan program in Lahore. Please contact Akhuwat Loan Contact The helpline team will guide you through the loan application process, answer any questions. And provide the necessary support to ensure your loan application processed efficiently.

A mortgage is a loan that you take out to finance the purchase of a home. It is a long-term loan typically repaid over several years. The property you purchase serves as collateral for the loan, and if you fail to make the mortgage payments, the lender can foreclose on the property.

Several factors come into play when determining mortgage eligibility. These include your credit score, income, employment history, debt-to-income ratio, and the amount of your down payment. Lenders also consider the property's appraisal value and condition.

A fixed-rate mortgage has a set interest rate that remains unchanged throughout the loan term. This means your monthly mortgage payments will also remain consistent. In contrast, an adjustable-rate mortgage (ARM) offers an initial fixed-rate period, after which the interest rate can fluctuate based on market conditions.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Subscribe our newsletter to get our latest update & news